Best Candlestick Patterns for Scalping

Candlestick patterns are a popular tool used by traders to visually analyze price movements of financial instruments such as stocks, commodities, and currency pairs.

Scalping is a trading strategy that involves making multiple trades within a short time frame, often within minutes, with the goal of profiting from small price movements. To be successful in scalping, it is important to identify patterns in the price action that indicate a potential trend reversal. Candlestick patterns can provide valuable insights into market sentiment and help scalpers make informed trading decisions. Some of the best candlestick patterns for scalping include the Bullish Engulfing Pattern, Hammer, Morning Star, and Piercing Line. These patterns can signal a change in momentum and provide potential trading opportunities for scalpers. However, it's important to note that while candlestick patterns can be useful, they should not be relied upon solely in making trading decisions and should always be used in conjunction with other forms of technical and fundamental analysis.

So, keeping in mind all of your needs here I come up with a detailed guide.

Download

How accurate are candle patterns?

Candlestick patterns can be a useful tool for traders to analyze market sentiment and identify potential trading opportunities. However, the accuracy of candlestick patterns can vary, and it's important to keep in mind that they are just one aspect of technical analysis and should not be relied upon solely in making trading decisions. Here are the steps to assess the accuracy of candlestick patterns:

Confirm the pattern:

It is important to confirm that the pattern is valid by ensuring that it meets the criteria for the specific pattern in question.

Consider market context:

The accuracy of a candlestick pattern can be influenced by the overall market context, such as the trend, volatility, and market conditions.

Check for confirmation:

It is always recommended to look for confirmation of the pattern, such as a follow-up candle that supports the pattern's interpretation or additional technical indicators that confirm the trend reversal.

Use in conjunction with other analysis:

Candlestick patterns should never be used in isolation but instead should be used in conjunction with other forms of technical and fundamental analysis.

Test with historical data:

The accuracy of a candlestick pattern can be tested by looking at its performance on historical data. This can provide valuable insights into the pattern's reliability and help traders make informed trading decisions.

In conclusion, while candlestick patterns can provide valuable insights into market sentiment, it is important to approach them with caution and to use them as part of a comprehensive trading strategy.

Best Candlestick Patterns for Scalping Detailed Guide

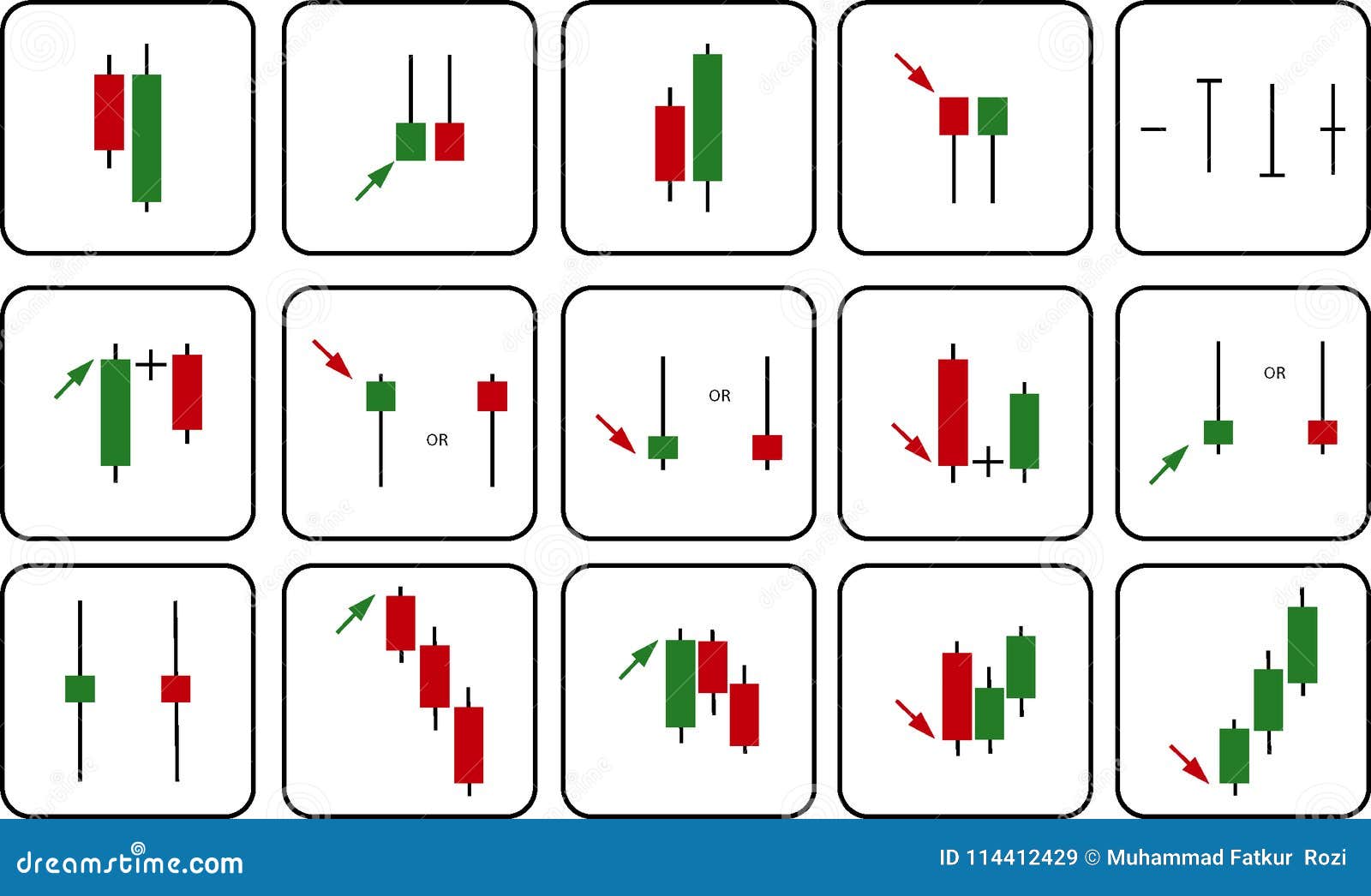

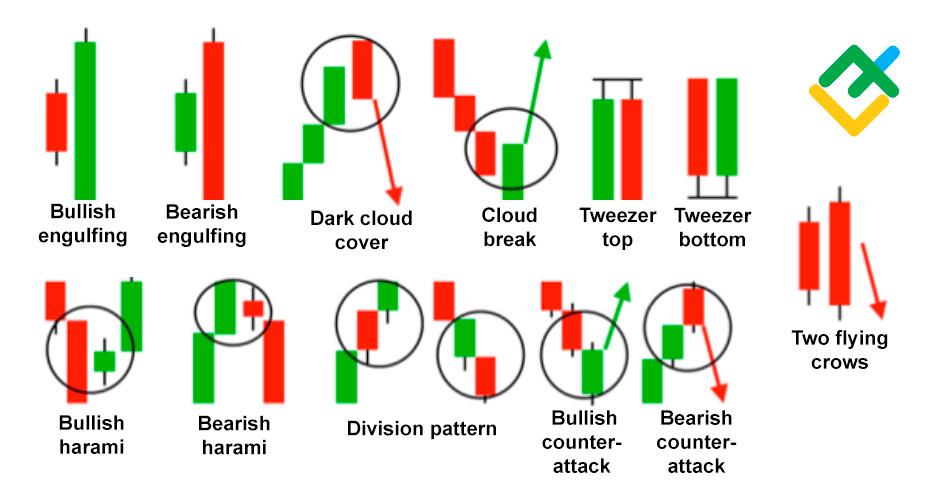

Bullish Engulfing Pattern:

This pattern occurs when a small red candlestick is followed by a large green candlestick, which completely engulfs the red one. This pattern suggests a bullish reversal in the market and is a signal to buy.

Hammer:

This pattern occurs when a small red or green candlestick is followed by a long lower shadow. This pattern suggests a potential bullish reversal and is a signal to buy.

Morning Star:

This pattern occurs when a small red candlestick is followed by a large green or doji candlestick, which is then followed by another small red candlestick. This pattern suggests a bullish reversal in the market and is a signal to buy.

Piercing Line:

Download

This pattern occurs when a small red candlestick is followed by a large green candlestick, which closes above the midpoint of the red candlestick. This pattern suggests a bullish reversal in the market and is a signal to buy.

Doji:

This pattern occurs when the opening and closing price of the candlestick are almost the same, forming a cross or plus sign. Doji patterns suggest indecision in the market and can signal a potential trend reversal.

Hanging Man:

This pattern occurs when a small red or green candlestick is followed by a long upper shadow. This pattern suggests a potential bearish reversal and is a signal to sell.

Shooting Star:

This pattern occurs when a small red or green candlestick is followed by a long upper shadow. This pattern also suggests a potential bearish reversal and is a signal to sell.

Dark Cloud Cover:

This pattern occurs when a small green candlestick is followed by a large red candlestick, which opens above the close of the green candlestick. This pattern suggests a bearish reversal in the market and is a signal to sell.

In addition to these patterns, it is also important to consider the overall market context, such as the trend, volatility, and market conditions, when interpreting candlestick patterns. Traders should also use other forms of technical and fundamental analysis to confirm the validity of the pattern and make informed trading decisions. As with all trading strategies, it is important to manage risk and have a solid trading plan in place to ensure success in scalping with candlestick patterns.

What is a strong bullish candle?

A strong bullish candle is a type of candlestick pattern that indicates bullish sentiment in the market. Here is a step-by-step guide to identify a strong bullish candle:

Definition:

A strong bullish candle is a candlestick with a long green body, indicating that the price has risen significantly during the trading period.

Length of the Body:

The length of the body should be relatively long, compared to the preceding and following candles. This indicates a strong bullish sentiment in the market, as buyers have pushed the price higher.

Little or No Upper Shadow:

A strong bullish candle should have little or no upper shadow, indicating that the price reached its high point near the beginning of the trading period and remained at that level for the majority of the period.

Consider the Market Context:

It is important to consider the overall market context, such as the trend, volatility, and market conditions, when interpreting a strong bullish candle.

Look for Confirmation:

It is recommended to look for confirmation of the pattern, such as a follow-up candle that supports the pattern's interpretation or additional technical indicators that confirm the trend reversal.

In conclusion, a strong bullish candle can be a valuable tool for traders to identify potential buying opportunities. However, as with all trading strategies, it is important to use it in conjunction with other forms of technical and fundamental analysis and have a solid trading plan in place to manage risk.

What is the best bearish candlestick pattern?

The best bearish candlestick pattern will depend on individual trader's preferences and the market conditions they are trading in. However, here is a step-by-step guide to identify one of the most popular bearish candlestick patterns: the Evening Star pattern:

Definition:

The Evening Star pattern is a three-candlestick pattern that signals a potential bearish reversal in the market.

First Candle:

The first candle is a long green or white candle, indicating bullish sentiment in the market.

Second Candle:

The second candle is a small, usually doji or spinning top candle, indicating indecision in the market.

Third Candle:

The third candle is a long red or black candle, indicating bearish sentiment in the market. This candle should close below the midpoint of the first candle, confirming the bearish reversal.

Consider the Market Context:

It is important to consider the overall market context, such as the trend, volatility, and market conditions, when interpreting the Evening Star pattern.

Look for Confirmation:

It is recommended to look for confirmation of the pattern, such as a follow-up candle that supports the pattern's interpretation or additional technical indicators that confirm the trend reversal.

In conclusion

I hope that you know the best candlestick patterns for scalping. candlestick patterns can be a valuable tool for scalping in the financial markets. Some of the best patterns for scalping include the Hammer, Bullish Engulfing, and Piercing Line patterns, which signal potential buying opportunities, and the Evening Star, Dark Cloud Cover, and Shooting Star patterns, which signal potential selling opportunities. However, it is important to use candlestick patterns in conjunction with other forms of technical and fundamental analysis and have a solid trading plan in place to manage risk and ensure success in scalping

No comments:

Post a Comment